BSA AML compliance programs require both customer accounts and transactions to be closely monitored for the possible detection of money laundering or other financial crimes. With the huge volume of data processed by every financial institution these days, it has become a really cumbersome task to monitor all activity and prioritize effectively what needs further review. This is why implementing a risk-scoring system would help streamline the monitoring and reporting processes much better.

According to Michael Taylor, “Risk scoring allows you to see the forest through the trees by assigning risk values to customers and transactions, based on factors that have been proven to impact money laundering and other illegal activity.” Businesses could focus resources on higher-risk areas that create the most significant threat by working risk scoring into transaction-monitoring programs.

Below are the necessary steps one needs to take in order to develop effective risk-scoring criteria and assessment.

Why is Risk Scoring Important for BSA AML Compliance?

Risk scoring is one of the critical elements that form part of BSA AML compliance. It enables a financial institution to focus on customers or transactions for review that would find us most valuable in the highest-risk areas. It provides a numerical risk value to different factors assessed in the risk assessment.

This makes the use of resources more effective in concentrating on monitoring high-risk areas and streamlines the review of lower-risk matters. Proper risk scoring is integral to any sound BSA/AML compliance program. According to FinCEN, the number of filings for SARs by financial institutions has increased by 20% in the past two years.

How to Establish Risk Scoring Criteria

In developing such criteria, a financial institution should consider the findings of its BSA/AML risk assessment regarding factors such as the types of customers the institution services, products, services, and geographic locations. By determining where the most significant threats lie, it becomes possible to develop some defined, specific criteria based on factors identified for the risk-scoring model as higher risk.

This might involve assigning a higher score to customers from specific foreign countries or to transactions above a particular dollar value. With proper criteria, any AML risk scoring will be accurate. The Economist Intelligence Unit’s 2023 Global Risk Report continues to highlight such regions, like Eastern Europe and Central Asia, as facing higher risks due to the continued prevalence of financial transparency problems.

Conducting the Initial Risk Scoring Assessment

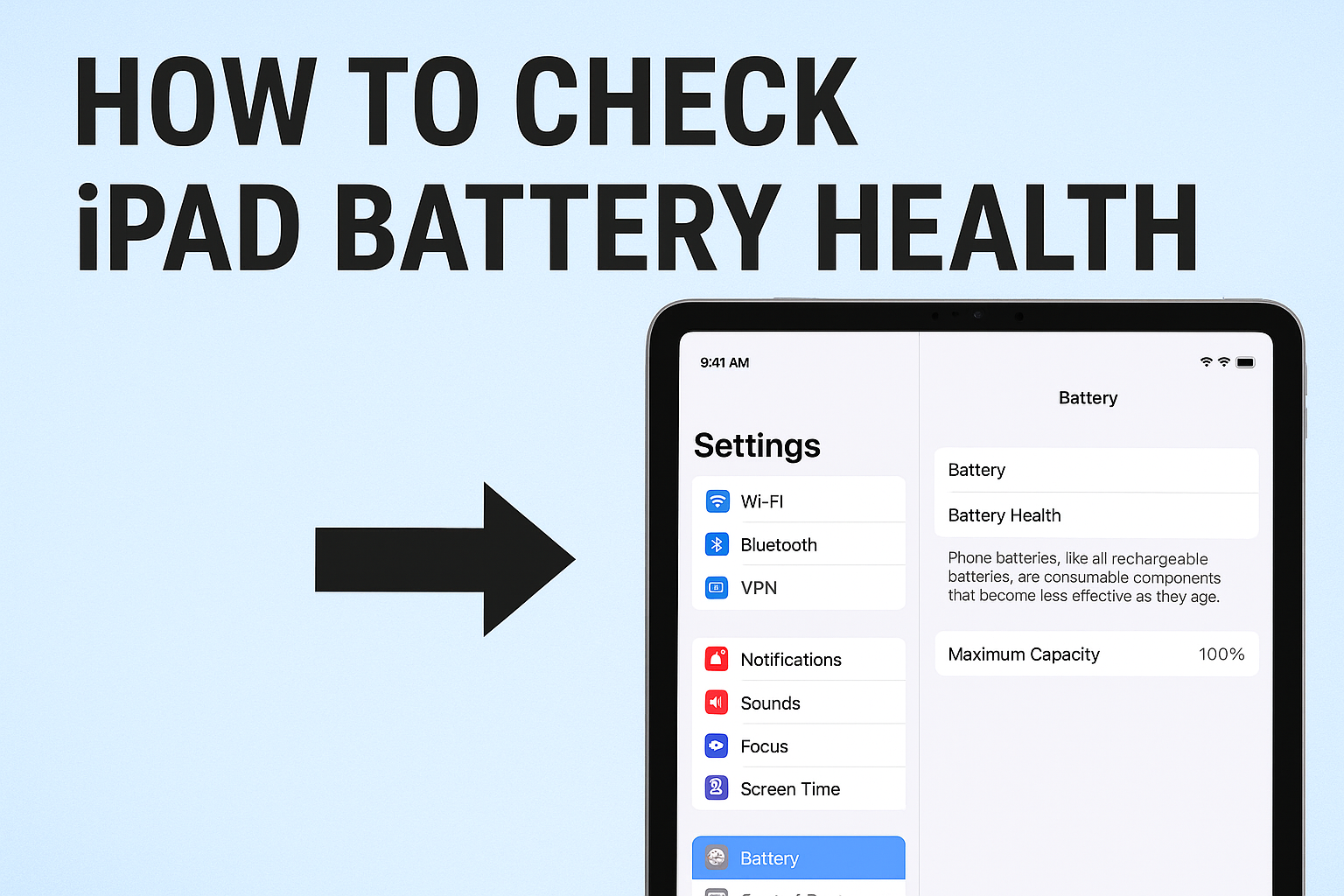

An organization will take its built-out criteria to calculate an initial risk score by grading existing customers and accounts. In these various data points, it will review customer profiles, their histories of payment, and transaction patterns.

The particular characteristics of the defined high-risk customer or transaction attribute scores are based on how they align. This baseline AML risk scoring provides a starting point for BSA/AML monitoring. The model will grow refined over time as more data is analyzed.

Monitoring Transactions and Accounts Using Risk Scores

With volumes of daily transactions running into the millions in many financial institutions, how is customer activity effectively monitored? One can filter transactions and accounts for closer review by applying risk scoring in such instances. Once initial risk scores have been analyzed, a baseline will be set. Ongoing monitoring can then be concentrated on activity related to higher-risk accounts and jurisdictions.

This may entail closer scrutiny of transactions involving some of those customers or higher-risk jurisdictions. Lower-risk accounts and transactions below set thresholds would warrant less frequent review. This targeted monitoring allows for effective risk management based on the level of possible risk indicated by the initial and then further risk scoring.

Bonus: See our solutions page to learn more about how our risk-scoring software, combined with advisory services, can help your bank optimize its transaction monitoring, reporting, and compliance.

Generating Risk-Based Alerts and Reports

An organization’s risk assessment and scoring allow for generating risk-based alerts and reports. In a 2023 survey by ACAMS, more than 60% of financial institutions adopted automated systems that flag high-risk transactions. Automated alerts and reports allow for transaction monitoring and overall risk management by highlighting only those specific matters that require special attention and filtering out lower-risk items.

Continually Refining Your Risk Scoring Model

Scoring will have to be improved further with growing customer data and ever-changing patterns of transactions. Only with experience does a financial institution gain deeper BSA AML risk assessment to enhance its scoring criteria and models. For instance, another type or variant of a transaction may arise that makes certain higher risks obvious upon closer analysis.

One previously low-risk rated jurisdiction could have risk levels increased due to the deteriorating economic or political relationship with the foreign country. In principle, it is possible to update the scoring system dynamically by periodically reviewing models and assessment factors.

This continuous process refines accuracy and aligns the scoring approach with the newest AML risk insight. A 2023 report from the World Bank showed that risk models of financial institutions have been recalibrated in response to rising economic instability in various regions that have suddenly flashed heightened risk profiles.

Contact our BSA AML compliance consultants to know how a risk scoring system can efficiently help your institution monitor and provide a needed boost to its overall risk management program.