In this era of growing technology, where businesses are getting closer to their success and growth by using advanced technology, they are also becoming vulnerable to various challenges. Fraudsters often generate fake business profiles with the help of forged and fake documents they create through artificial intelligence. It makes it harder to evaluate the nature of provided documents with manual or traditional verification methods. Therefore, organizations require the most advanced solution for fraud identification and security of their business from financial crimes and other harmful consequences.

Companies can utilize Know Your Business (KYB) compliance solutions for fraud prevention, as this service ensures a complete screening and evaluation of organizations.

What is Know Your Business (KYB)?

Know Your Business (KYB) is a regulatory compliance process and a necessary service to utilize for business fraud prevention. This solution is designed to thoroughly screen entities in terms of finding their authenticity and trustworthiness which helps in checking appropriateness regarding collaborations. WIth the help of KYB compliance service, businesses not only prevent fraud but have legal security as well.

Growing financial crimes make it necessary to utilize effective measures for the identification of organizational financial reliability. A business that is involved in any financial crime can lead to heavy fines and complications for partner organizations. Therefore, it is very important to utilize KYB service, which ensures transparency of potential entirety by providing multi-step verification.

How KYB Can Help in Business Fraud Investigation?

Know Your Business (KYB) service allows companies to identify fraud risks. Many companies operate illegally just to serve as a medium for money laundering and financial terrorism. They can bring serious consequences for all the organizations and sceyrs they work with. Therefore, it is very important to utilize KYB service which assists in the thorough investigation of organizations and offers the utmost security from such organizations which are not legally registered.

Other than fake business entities, many shall companies reach out to organizations for performing various ilelevot activities. A shall company does not have any physical existence but only has paperwork and is registered in online records. It is easy prey to money laundering. Therefore, within the business landscape, it is necessary to identify shall organisations which can lead to various complications for associated business. Therefore, with the help of the Know Your Business (KYB) service, a company can find shall organisations, and it can secure itself from future complications.

Steps in KYB Solution for Thorough Screening

Following are some basic steps of KYB service which contributes in fraud prevention:

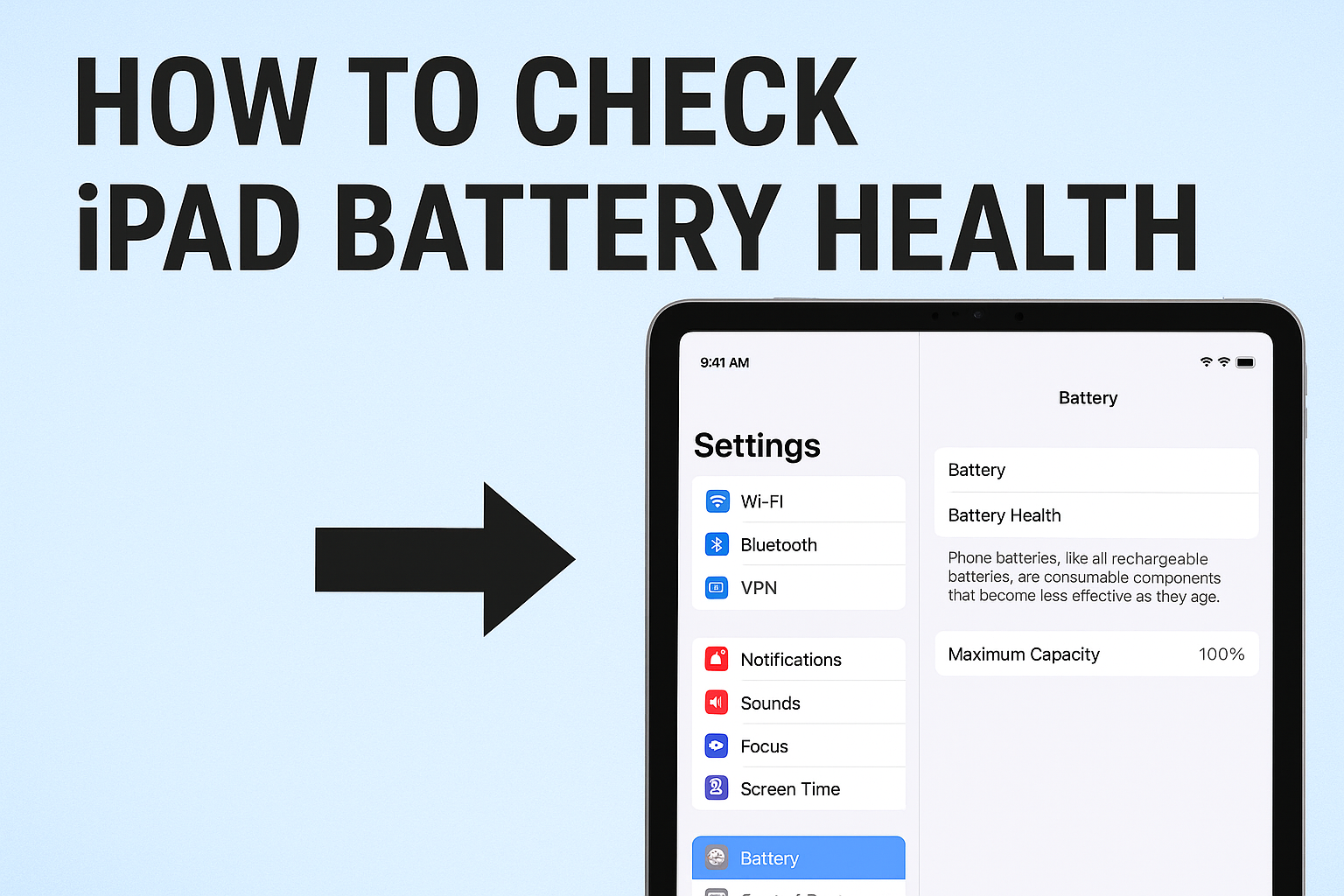

Document Verification

There is the step of document screening within the Know Your Business (KYB) process. The KYB is no longer manual, but it involves artificial intelligence in its working and ensures a stre alien process for company document verification to find their nature regarding authenticity. Many fraudsters utilize fake or forged business documents which are difficult to identify through the human eye. But with the help of optical character recognition technology, the KYb process fetches data from the documents and converts it into text form tio compare it across various records and watchlists to find the authenticity. With the help of digital document verification services, the KYB process offers a thorough investigation of companies and contributes to fraud prevention.

Financial Health Screening

The KYB service offers company financial health verification and works for business fraud investigation as it allows a complete view of finances. It enables organizations to secure ehri landscape from money laundering and financial terrorism. It not only helps check the company’s financial standing but also contributes to overcoming money laundering penalties.

UBO Checking

Know Your Business (KYB) compliance process consists of aUBO screening process and it helps to validate the ownership structure of a business. Companies that do not have a thorough UBO screening service cannot ensure business fraud protection. Ultimate Beneficial Owners (UBOs) are significant entities within the business structures that have at least 25% of total shares and are directly and indirectly necessary to evaluate through the screening of an organization.

Ongoing Monitoring

Know Your Business service is only a time process for business fraud investigation but helps companies to regularly monitor and find changing behavior of entities. It hel[s to overcome future complications and helps organizations to secure their landscape from high-risk entities in the future.

Final Words

It is necessary for businesses to utilize effective measures for fraud prevention. In this era of technology, where businesses can streamline their process for operations through automation, fraudsters are also utilizing advanced methods for devising their strategies. With traditional verification methods , businesses can no longer secure their landscape from fraud. Therefore , it is very important to utilize advanced security measures and fraud prevention protocols which can help in establishing secure business relations across companies.